Enhancing Your Python Trading Strategies with Stop Losses

Written on

Chapter 1: Understanding Stop Losses in Trading

In the realm of crafting trading strategies using Python, one of the most vital considerations is the implementation of a stop loss. A stop loss acts as a safeguard, limiting potential losses by automatically closing a trade when it reaches a predefined price point. This article delves into the significance of stop losses within Python strategies and their impact on backtesting results.

Implementing a stop loss is essential for effective risk management. Traders who neglect to use a stop loss risk incurring losses greater than intended. Given the market's inherent unpredictability, price fluctuations can occur rapidly, adversely affecting a trader’s position. By establishing a stop loss, traders can mitigate these unforeseen price movements, capping losses to a designated percentage of their trading account.

Section 1.1: The Role of Stop Losses in Emotional Management

Another crucial function of stop losses in Python strategies is to help traders evade emotionally-driven decisions. Without a stop loss, traders may feel compelled to cling to losing positions, hoping for a market reversal. Such behavior often stems from emotions—fear, greed, or hope—rather than sound trading strategies. Setting a stop loss enables traders to remove emotional impulses from their decision-making process, adhering to a structured plan grounded in risk assessment and market analysis.

Subsection 1.1.1: The Impact of Stop Losses on Backtesting

Backtesting is an essential step in developing trading strategies in Python. This process involves evaluating a strategy against historical market data to assess its performance under various conditions. However, the accuracy of backtesting results can be compromised if stop losses are improperly applied.

Consider a scenario where a trader creates a Python strategy focused on taking long positions in a stock. If no stop loss is set, backtesting might suggest the strategy is profitable. Yet, once real trading begins, a significant market downturn could lead to substantial losses if the trader holds on to a declining stock. Conversely, had a stop loss been in place during backtesting, the results might have been notably different. The stop loss would automatically close the trade at a set price point, limiting potential losses and enhancing the robustness of the strategy across varying market conditions.

In summary, stop losses are a fundamental aspect of Python trading strategies. They facilitate risk management, help avoid emotional decision-making, and yield more reliable backtesting results. By diligently incorporating stop losses into your trading strategies, you can reduce losses and increase your likelihood of achieving success in the financial markets.

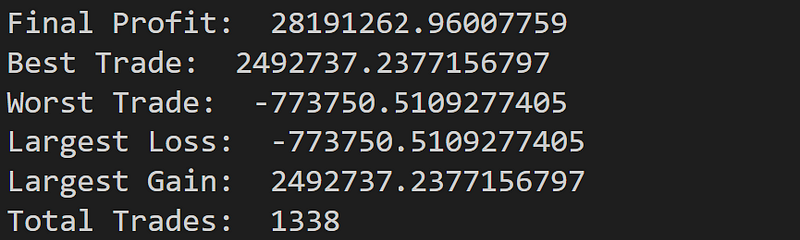

Now, let’s examine a Python backtest with a 3% stop loss using the Trix Strategy. Here’s an example code snippet:

df["signal"] = signals

print(signals)

investment = 1000

current_investment = 1000

invested_amount = 0

fees = 0

profit = 0

is_invested = False

best_trade = -99999999

worst_trade = 99999999

largest_loss = 0

largest_gain = 0

total_trades = 0

loss_threshold = 0.03 # Stop loss threshold at 3% loss

loss_amount = 0 # Variable to track loss amount

for i in range(500, len(df)):

signal = df.iloc[i]['signal']

close = df.iloc[i]['close']

if signal == 1 and not is_invested:

entry_point = close

quantity = (current_investment / close)

invested_amount = quantity * close

is_invested = True

elif signal == -1 and is_invested:

profit = quantity * (close - entry_point) - 2

current_investment += profit

invested_amount = 0

total_trades += 1

is_invested = False

largest_gain = max(largest_gain, profit)

largest_loss = min(largest_loss, profit)

best_trade = max(best_trade, profit)

worst_trade = min(worst_trade, profit)

elif is_invested:

# Check if stop loss threshold has been reached

loss = invested_amount - (quantity * close)

if loss > invested_amount * loss_threshold:

profit = invested_amount * (1 - loss_threshold) - invested_amount - 2

current_investment += profit

invested_amount = 0

total_trades += 1

is_invested = False

largest_gain = max(largest_gain, profit)

largest_loss = min(largest_loss, profit)

best_trade = max(best_trade, profit)

worst_trade = min(worst_trade, profit)

else:

loss_amount = loss # Update loss_amountelse:

pass

final_profit = current_investment - investment

print("Final Profit: ", final_profit)

print("Best Trade: ", best_trade)

print("Worst Trade: ", worst_trade)

print("Largest Loss: ", largest_loss)

print("Largest Gain: ", largest_gain)

print("Total Trades: ", total_trades)

Next, let’s review the backtest results of the Trix Strategy:

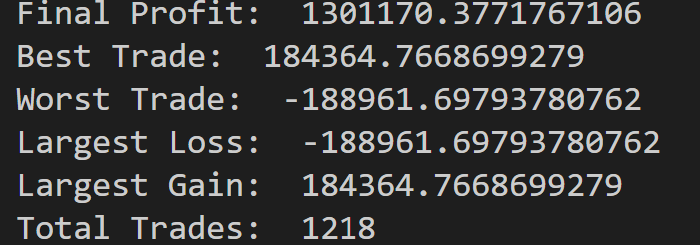

Before implementing the stop loss: