# Rethinking Ethereum: Moving Beyond Environmental Concerns

Written on

Chapter 1: The Rise of Ethereum

Have you heard tales of early investors who struck it rich? For instance, a $1,000 investment in Tesla back in 2019 when shares were priced at $23 would have yielded around $100,000 today. Similarly, had you invested in Amazon after the dot-com crash when stocks were just $8, you would have enjoyed a staggering 500-fold return. Currently, about 40% of cryptocurrency investors hold Ethereum, which has surged by 26% over the past year. With its substantial market capitalization, rapid adoption, and expanding applications, it's crucial to reconsider your views on this digital asset. Although the potential rewards are vast, so too are the inherent risks. While I can't assure you that investing in emerging technologies will lead to astronomical returns, it remains a compelling option compared to many alternatives.

However, skepticism towards new technologies often hinders exploration. Environmental concerns frequently serve as a primary obstacle. It’s ironic that we seldom critique the ecological footprint of widely accepted technologies like cars, planes, or streaming services such as YouTube and Netflix. We don’t label fine art, money, gold, or diamonds as fraudulent schemes.

Strap in, as my research reveals a key insight: the resistance to new technology is often rooted in fear of change.

Section 1.1: Understanding Resistance to New Technologies

In his book Innovation and Its Enemies, Professor Juma explores the various reasons people resist technological advancements. His work draws from historical instances of innovation and highlights the roles of both experts and the public in shaping acceptance of new ideas. Here are several critical points regarding public resistance to new technologies:

- People often push back against innovations to preserve the status quo.

- Individuals may hesitate to embrace new technologies if they perceive benefits as favoring a select few.

- Skepticism can arise if the public believes that advantages will be realized only in the distant future.

- Acceptance is more likely when new technologies do not challenge existing beliefs or social standings.

These points are not unique to Ethereum or any specific innovation but provide valuable insights into the factors that shape public attitudes towards new developments. Ultimately, it takes time for new technologies to gain widespread acceptance and become commonplace.

Section 1.2: Environmental Efficiency of Ethereum

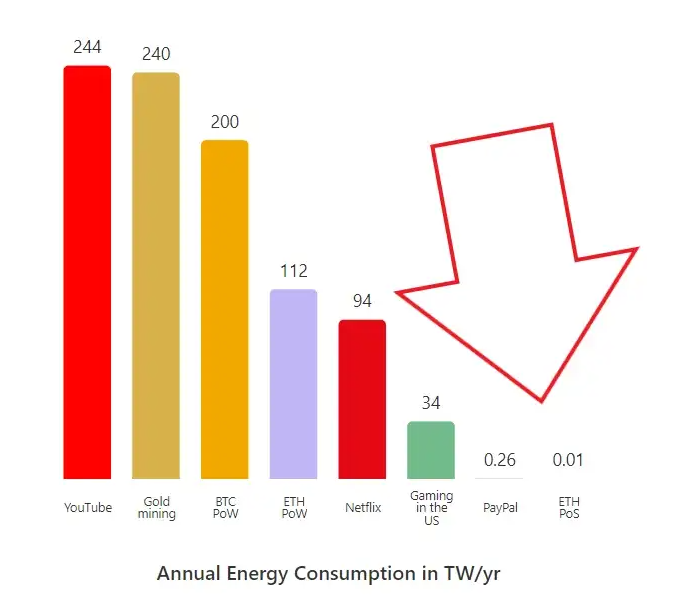

Did you know that Ethereum is now more energy-efficient than platforms like YouTube and Netflix? One of the main criticisms of cryptocurrencies has been their adverse environmental impact, primarily due to the energy-intensive Proof-of-Work consensus mechanism. However, Ethereum recently completed a significant transition to a Proof-of-Stake model, resulting in a remarkable 99.5% reduction in energy consumption.

Environmental advocates advocating for a ban on Ethereum were caught off guard by this shift.

Section 1.3: Debunking the Ponzi Scheme Myth

Many people inaccurately label Ethereum as a Ponzi scheme. This is a misrepresentation on multiple fronts. A Ponzi scheme is an investment fraud where returns for older investors are paid using the capital from new investors, promising high returns with little risk. Ethereum, devoid of a central authority or any single point of failure, is not susceptible to such fraud. There’s no intermediary reinvesting or redistributing your Ethereum to unsuspecting parties.

While it is indeed a volatile asset with significant risk, Ethereum possesses the potential to serve as a form of decentralized internet currency due to its innovative use of "smart contracts." These contracts are self-executing codes validated and enforced on a network, allowing for traceable, transparent, and irreversible transactions without intermediaries. In contrast, Ponzi schemes thrive on a lack of transparency.

Section 1.4: The Mindset Shift: Expectation of Value

While predicting the future is inherently uncertain, examining the past can help shape our expectations. Currently, decentralized digital assets account for approximately 0.5% of the global money supply. This figure may fluctuate in the coming decade due to factors such as regulatory changes and increased digital literacy.

I firmly believe that the percentage of digital assets will rise over time, as our society becomes more digitally integrated. Esteemed cryptocurrency expert Punk6529 emphasizes the concept of "expected value" when analyzing digital assets.

His analysis suggests that if there's a 50% chance that cryptocurrency's share of total assets will rise to 1%, and a 50% chance it will decline to zero, the expected value remains positive. Thus, even today, he advocates for investment in cryptocurrency.

Final Thoughts: The Future of Ethereum

Ethereum's smart contract technology faces competition from other blockchain platforms and must address scalability and decentralization issues. Similarly, Bitcoin and other blockchain technologies encounter their own challenges. However, it’s essential to remember that over 4,000 active developers are dedicated to enhancing Ethereum’s framework. Just as humanity has refined other technologies in the past, solutions to these challenges will emerge.

Trusting the commitment and expertise of these developers is crucial. If you're interested in exploring more insights on Web3, consider joining our community. Your membership supports the writers you appreciate, and I may earn a small commission if you use my link.

This article is for informational purposes only and should not be construed as financial, tax, or legal advice. Please consult a financial professional before making significant investment decisions.